The Ultimate Guide To Insurance

Wiki Article

Not known Details About Insurance

Table of ContentsA Biased View of InsuranceThe smart Trick of Insurance That Nobody is Talking About5 Simple Techniques For InsuranceGetting The Insurance To WorkThe Greatest Guide To InsuranceSome Ideas on Insurance You Need To Know

While we typically can't protect against the unforeseen from happening, often we can get some security. Insurance is suggested to safeguard us, a minimum of monetarily, should certain points take place. But there are countless insurance policy alternatives, as well as lots of economists will claim you require to have them all. It can be hard to establish what insurance policy you really require.Elements such as youngsters, age, way of living, and employment advantages play a duty when you're building your insurance portfolio. There are, nonetheless, four types of insurance coverage that a lot of economic experts recommend we all have: life, health and wellness, automobile, and also long-lasting special needs.

houses depend on dual earnings. The study also found that a quarter of family members would certainly experience economic challenge within one month of a wage earner's death. The 2 standard kinds of life insurance policy are conventional whole life as well as term life. Simply discussed, whole life can be utilized as an income tool as well as an insurance tool.

Insurance Fundamentals Explained

Term life, on the various other hand, is a policy that covers you for a set amount of time. Variables to take into consideration include your age, profession, and also number of reliant youngsters.

If that's not a choice, you'll need to acquire personal wellness insurance. Long-Term Impairment Insurance Coverage Lasting disability insurance is the one sort of insurance a lot of us assume we will certainly never ever need. Yet, according to data from the Social Safety And Security Administration, one in 4 employees getting in the labor force will certainly become impaired and will certainly be incapable to work prior to they get to the age of retired life.

While health insurance pays for a hospital stay as well as medical costs, you're still left with those everyday expenses that your income usually covers. Lots of employers provide both short- and also lasting disability insurance as part of their advantages plan.

Insurance - Questions

25 million cops reported cars and truck accidents in the US in 2020, according to the National Highway Website Traffic Safety And Security Management. An approximated 38,824 people died in auto accidents in 2020 alone. According to the CDC, auto accidents are among the leading reasons of fatality around in the United States and worldwide.3 million vehicle drivers and travelers were wounded in 2020. In 2019, financial costs of fatal car crashes in the US were around $56 billion. While not all states require chauffeurs to have auto insurance policy, most do have policies pertaining to economic responsibility in the event of a crash. States that do call for insurance policy conduct periodic random checks of motorists for proof of insurance coverage.

Insurance Fundamentals Explained

Once again, just see this here like all insurance policy, your specific conditions will certainly establish the cost of vehicle insurance. To ensure you obtain the you could try this out ideal insurance policy for you, contrast numerous rate quotes and also the coverage supplied, as well as examine occasionally to see if you get lower rates based on your age, driving record, or the location where you live.

Life will toss you a curve ball there's no doubt about that. Whether you'll have insurance policy when it does is an additional issue completely. dig this Insurance policy barriers you from unanticipated expenses like clinical costs. As well as while the majority of people recognize that insurance coverage is essential, not every person knows the different kinds of insurance available as well as exactly how they can help.

Insurance Can Be Fun For Anyone

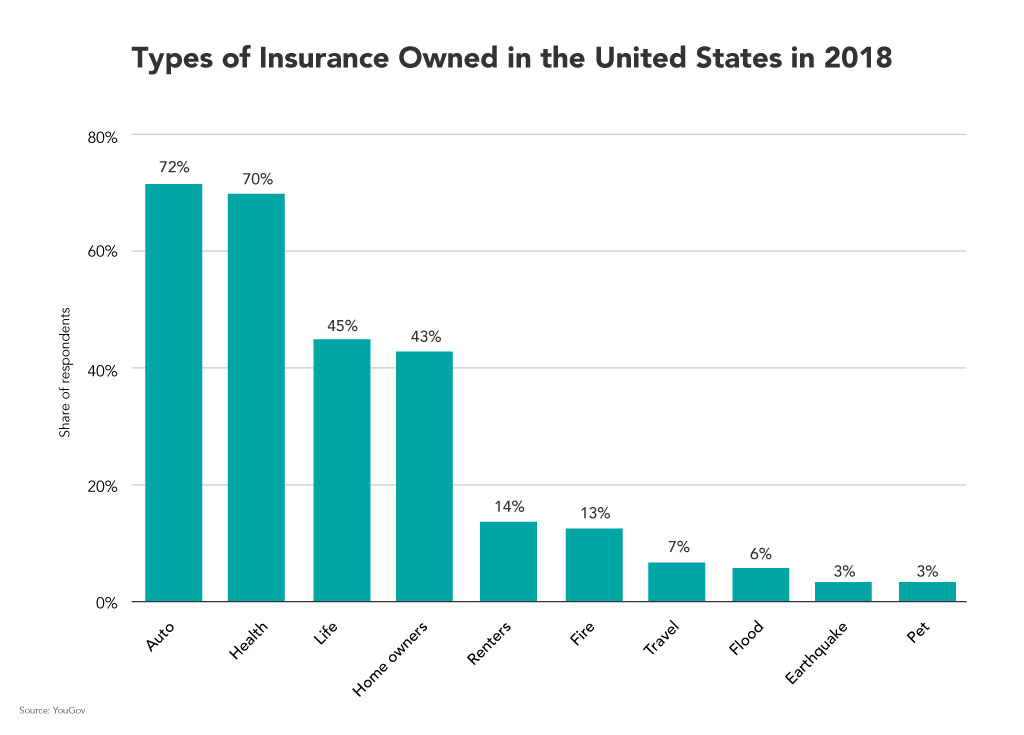

children). Those with dependents In case of death, a life insurance policy policy pays a beneficiary an agreed-upon quantity of money to cover the expenditures left by the deceased. A recipient is the person or entity named in a plan that obtains benefits, such as a partner. Maintain your home as well as keep its building value high, plus be covered when it comes to significant damages, like a home fire.Lots of property managers need it. Tenants Renters insurance policy is utilized by tenants to cover personal effects in instance of damage or burglary, which is not the responsibility of the property owner. Preparation to jet off to a new location? Make certain the price of your plane tickets is covered in situation of medical emergencies or various other events that might create a trip to be reduced brief.

Paying right into pet insurance coverage might be more affordable than paying a round figure to your vet ought to your family pet need emergency medical treatment, like an emergency clinic see. Pet dog proprietors Animal insurance policy (mainly for canines as well as cats) covers all or part of vet treatment when a pet is injured or sick.

Some Known Facts About Insurance.

Even more than 80% of uninsured respondents who had an emergency either could not afford the prices or required 6 or even more months to settle the expenses. While Medicare and Medicaid receivers were the least most likely to have to pay for emergency situation prices, when they did, they were the least able to manage it out of the insured population.Report this wiki page